|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

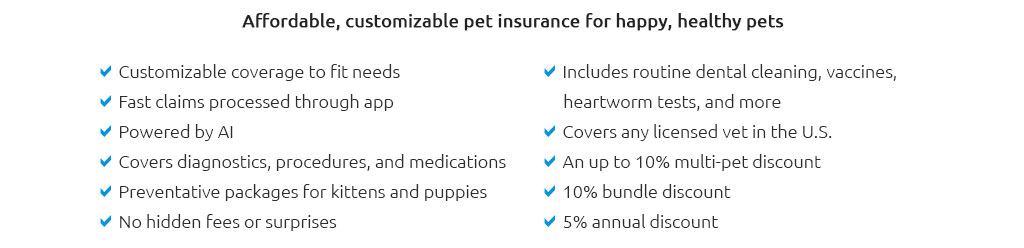

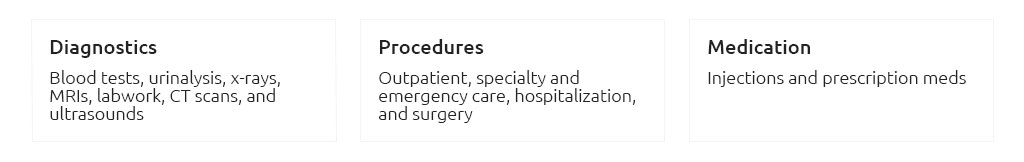

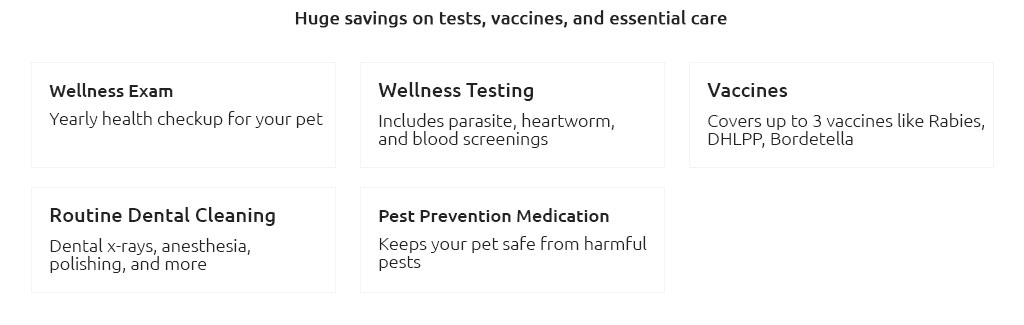

Best Dog Insurance Plans: A Comprehensive GuideAs a devoted pet owner, ensuring the well-being of your furry companion is likely one of your top priorities. In recent years, the popularity of dog insurance plans has soared, offering a safety net for unexpected veterinary expenses. But with an array of options flooding the market, how do you determine the best dog insurance plan for your beloved pet? This guide aims to unravel the complexities, presenting you with a clear understanding of what to look for in a plan and why investing in one could be a wise decision. Firstly, it's crucial to recognize the vast differences in coverage options available. While some plans offer comprehensive coverage that includes accidents, illnesses, and wellness care, others might be more limited, focusing solely on accidents or specific conditions. A good starting point is to assess your dog's unique needs, taking into account factors such as age, breed, and existing health conditions. Notably, the cost of veterinary care has been steadily rising, which means having insurance can be a financial lifesaver. Consider a scenario where your dog requires emergency surgery; without insurance, the out-of-pocket costs could be overwhelming. Insurance provides peace of mind, allowing you to make health decisions based on what's best for your pet rather than financial constraints. Key Features to Consider

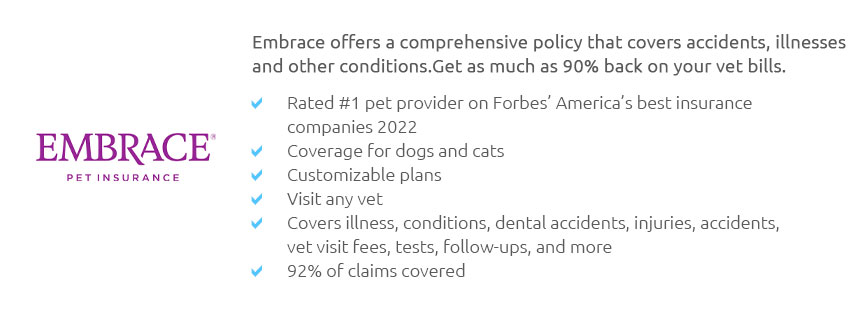

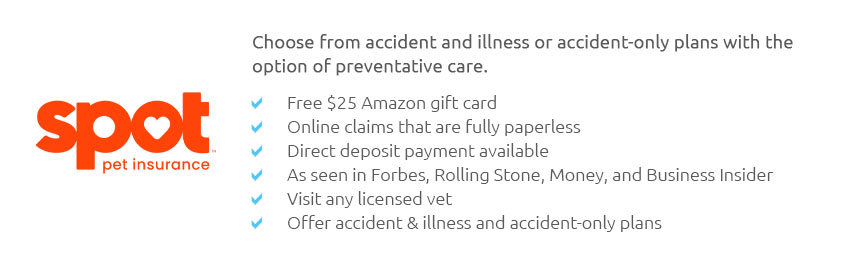

Our Top PicksBased on extensive research, some of the top contenders in the dog insurance space include Healthy Paws, known for its comprehensive coverage and straightforward claims process; Embrace Pet Insurance, which offers a customizable approach allowing you to tailor your coverage; and Nationwide Pet Insurance, unique for its coverage of exotic pets in addition to dogs. Each of these providers brings something distinct to the table, making it essential to weigh their pros and cons relative to your specific needs. Frequently Asked QuestionsWhat is the best age to get dog insurance? The best age to get dog insurance is when your dog is young and healthy. This ensures that you avoid exclusions for pre-existing conditions and typically results in lower premiums. Can older dogs be insured? Yes, older dogs can be insured, although options may be more limited and premiums higher. It's advisable to check with different providers for policies that cater to senior pets. Is dog insurance worth it? For many pet owners, dog insurance is worth it due to the financial protection it offers against unexpected and costly veterinary bills. It's especially valuable if your pet is prone to health issues. What does dog insurance typically cover? Dog insurance typically covers accidents, illnesses, surgeries, and sometimes wellness care, depending on the policy. It's important to review specific policy details to understand coverage scope. How do I choose the right dog insurance plan? To choose the right plan, assess your dog's health needs, compare different policies, consider coverage limits, and weigh costs against potential benefits. Reading reviews and consulting with your vet can also provide valuable insights. Ultimately, the best dog insurance plan is one that aligns with your financial situation and provides comprehensive coverage for your pet's health needs, ensuring you can enjoy many happy and healthy years together. https://www.embracepetinsurance.com/dog-insurance

Get your four-legged companion the best vet care, and we can help cover the bill. Our affordable and ... https://www.petinsurancereview.com/

See the best pet insurance providers - Embrace. 4.9. 17,992. $100 $1,000 annually - Healthy Paws. 4.9. 10,122. $250, $500 or $750 annually - Trupanion. 4.9. https://www.quora.com/What-is-the-best-type-of-dog-insurance-to-get

Comprehensive plans that cover accidents, illnesses, and hereditary conditions are often recommended. Providers like Embrace Pet Insurance and ...

|